How To Get People To Like Credit Card Apr | credit card apr

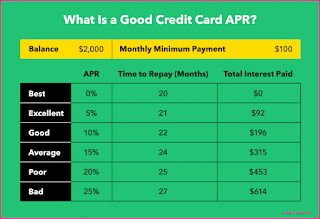

APR (Annual Percentage Rate) is what determines the amount that you pay to borrow from your credit card company each month. It is an interest rate that is determined by your credit card company, the credit card issuer, and the credit card company that issue the card to you. How much do you pay in interest each year on your credit card balance?

APR stands for Annual Percentage Rate and it's the amount of interest that you are charged at the end of every month. APR is a major factor in credit card interest rates because it determines how much interest you will pay throughout the year and determines how much your monthly bill will be. So, what is APR and why is it significant? The APR (Annual Percentage Rate) shows how much you need to borrow money from the credit card company each month. You are only charged APR on the outstanding balance when you carry a credit card balance from month to month or the entire balance if you are paying off the credit card debt. Most credit cards have various kinds of APR, which differ based on the card issuer and how frequently you use the credit card.

Some credit card companies charge different kinds of APR. So, when you look for an APR figure out the APR of all the credit card companies that are available to you. Make sure that it's the same kind of APR across different credit cards. If it isn't, it's usually okay to shop around for the best possible interest rates and remember that APR is just one aspect of the credit card payments that you need to consider. To make sure that you are making the most out of your credit card payments, read the terms and conditions as well as the annual fees, and grace periods, late payment penalties, and other costs that are included in your credit card payments.

How can you get the best credit card APR? First, try to pay as much as you can every month towards your credit card balance. Paying more may get you a better rate, but it's probably going to cost you more in the long run if you are not able to pay off your balances each month because you are paying more interest. For many people, the best kind of interest rate on their card balance is the prime rate. The prime rate is typically lower than the other rates on credit cards. If you want the lowest possible interest rate, your best bet would be to transfer your balance to a lower-rate card with a lower interest rate.

Check your credit card APR regularly. Credit card companies are not allowed to include interest rates in the advertised APR because they are considered as service charges. In essence, credit card APRs are expense account, in the sense that you pay them whether or not you make any purchases. The APR may seem low, but they add up very quickly. A low APR is great when you're just starting out, but once you start accumulating debt, it becomes quite costly.

Another way to keep your credit card APR down is to limit the number of purchases you make using your credit card each month. If you use your card to make a purchase such as a dinner out, then limit your dining out to a certain amount each month (preferably less than your total credit card APR). By doing so, you won't be charged a high interest rate for making purchases at restaurants, and you'll also limit the number of times that you pay interest on your balance, which will also help you keep your APR down. Of course, if you don't have a lot of disposable income, you'll still want to limit your purchases using your credit card so that you'll never be charged an APR that is too high. Even if you only use your card a few times per month, you could still save a lot of money by paying a lower interest rate.

It's also important to understand the different types of credit card APR that are out there. There are basically three different types, and they include the introductory rate, the standard APR and the variable APR. Each one has its own pros and cons, which mean that it's best to learn about each type and weigh your personal financial situation to determine which one would be the best for your financial life. Also, since these APRs can change over time, it's a good idea to understand how they affect your financial life. For example, if you suddenly find yourself with a large balance, you could end up being charged a higher interest rate because of the introductory rate, whereas if you pay your balance off more quickly, you might find that your monthly payments go down.

Finally, it's important to understand what a negative balance and a zero APR mean in terms of your credit report. A negative balance means that you are past due on your account, while a zero APR simply means that you have an interest rate that is the lowest on the credit report. In order to ensure that you don't find yourself in debt, it's best to try to avoid getting any balances on credit cards at all costs. After all, credit card APR is what determines how much interest you will be charged, and if you get yourself too deep into debt, you might not be able to make the minimum payments anymore, regardless of what type of credit card APR you might have. If you are looking to reduce your credit card APR, the best way to do so is to make sure that you know what the interest rate on your accounts is and to try to pay as much as possible each month, as long as it fits into your budget.

Post a Comment for "How To Get People To Like Credit Card Apr | credit card apr"