13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card

Editor’s Score: (4.3/5)

rewards rate: 5.0

welcome bonus: 4.5

annual fee: 3.0

other costs fees: 5.0

intro apr: 4.0

other benefits: 4.0

simplicity: 4.0

annual allotment rate: 3.5

Last adapted March 23, 2022

All reviews are able by NextAdvisor staff. Opinions bidding therein are alone those of the reviewer. The information, including agenda ante and fees, presented in the assay is authentic as of the date of the review.

Blue Banknote Preferred® Agenda from American Express

Editor’s Score: (4.3/5)

rewards rate: 5.0

welcome bonus: 4.5

annual fee: 3.0

other costs fees: 5.0

intro apr: 4.0

other benefits: 4.0

simplicity: 4.0

annual allotment rate: 3.5

Last adapted March 23, 2022

All reviews are able by NextAdvisor staff. Opinions bidding therein are alone those of the reviewer. The information, including agenda ante and fees, presented in the assay is authentic as of the date of the review.

6% Banknote Aback at U.S. supermarkets on up to $6,000 per year in purchases (then 1%… Read Added ). 6% Banknote Aback on baddest U.S. alive subscriptions. 3% Banknote Aback on alteration including taxis/rideshare, parking, tolls, trains, buses and more. 3% Banknote Aback at U.S. gas stations. 1% Banknote Aback on added purchases.

Editor’s Score: (4.6/5)

rewards rate: 5.0

welcome bonus: 4.5

annual fee: 5.0

other costs fees: 3.0

intro apr: 5.0

other benefits: 3.5

simplicity: 5.0

ongoing apr: 3.0

Last adapted March 23, 2022

All reviews are able by NextAdvisor staff. Opinions bidding therein are alone those of the reviewer. The information, including agenda ante and fees, presented in the assay is authentic as of the date of the review.

Wells Fargo Active Cash℠ Card

Editor’s Score: (4.6/5)

rewards rate: 5.0

welcome bonus: 4.5

annual fee: 5.0

other costs fees: 3.0

intro apr: 5.0

other benefits: 3.5

simplicity: 5.0

ongoing apr: 3.0

Last adapted March 23, 2022

All reviews are able by NextAdvisor staff. Opinions bidding therein are alone those of the reviewer. The information, including agenda ante and fees, presented in the assay is authentic as of the date of the review.

Earn absolute 2% banknote rewards on purchases.

Intro offer:

Annual fee:

Regular APR:

Recommended acclaim score:

6% Banknote Aback at U.S. supermarkets on up to $6,000 per year in purchases (then 1%). 6% Banknote Aback on baddest U.S. alive subscriptions. 3% Banknote Aback on alteration including taxis/rideshare, parking, tolls, trains, buses and more. 3% Banknote Aback at U.S. gas stations. 1% Banknote Aback on added purchases.

Pros and Cons

Pros

Cons

Pros

Cons

Additional Agenda Details

NextAdvisor’s Take

The Blue Banknote Preferred from American Express and Wells Fargo Active Banknote cards are both banknote accolade heavyweights, with high-value rewards on accustomed spending. While the Blue Banknote Preferred offers tiered benefit rewards with up to 6% banknote aback in assertive categories (up to limits) the Wells Fargo Active Banknote comes with a collapsed 2% banknote rewards on purchases. How you spend, forth with your alertness to pay an anniversary fee, what you’re attractive for in an addition offer, and accretion options can all advice you adjudge amid these top banknote aback picks.

The Blue Banknote Preferred® Agenda from American Express and the Wells Fargo Active Cash℠ Agenda are two of our admired cards for earning banknote aback rewards on accustomed spending. Plus, they appear with some abundant benefits, acceptable bonuses, and anterior offers.

But there are some cogent differences amid the two. Including their differing types of banknote aback rewards structures. Where the American Express Blue Banknote Preferred is a tiered benefit class banknote aback agenda that offers added rewards in baddest spending categories, the Wells Fargo Active Banknote Agenda is a flat-rate banknote aback acclaim agenda that doles out 2% banknote aback on every purchase.

There are added appropriate factors to analyze amid these two cards — including fees, perks, and accretion options. Before you choose, here’s aggregate you allegation to apperceive about what both cards offer.

6% aback on baddest U.S. alive subscriptions

3% banknote aback at U.S. gas stations and on transit

1% aback on added purchases

• Global Assist hotline

• Biking and acquirement protections

• Cell buzz protection

With the American Express Blue Banknote Preferred, you can acquire $300 afterwards spending $3,000 on purchases aural six months of anniversary opening. This works out to about $500 per ages for the aboriginal six months.

The Wells Fargo Active Banknote Agenda has a analogously lower acceptable offer, but additionally requires beneath spending. With this card, you’ll get $200 in benefit banknote aback you absorb at atomic $1,000 on purchases aural three months, or about $334 per ages over that timeline.

If you accept a ample accessible acquirement or your approved anniversary already allows for at atomic $500 in anniversary spending, the Blue Banknote Preferred offers added banknote aback afterwards anniversary opening. But the $200 Wells Fargo Active Banknote action isn’t bad either, and may be a bigger fit for abate budgets.

Both cards action abundant banknote aback rewards, but your top aces will depend on your alone spending.

The American Express Blue Banknote Preferred offers tiered rewards in benefit categories. You’ll get 6% aback on up to $6,000 spent at U.S. supermarkets per year (then 1% back), 6% aback on baddest U.S. alive subscriptions, 3% banknote aback at U.S. gas stations and on alteration and 1% aback on added purchases. This agenda is a acceptable best to acquire rewards on accepted accustomed purchases — abnormally with ascent grocery and gas prices.

Keep in apperception that the 6% aback amount at U.S. supermarkets is capped afterwards you absorb $6,000 per year. Many families absorb a lot added on advantage than that. In fact, the boilerplate ancestors of four with two adults beneath age 50 and two kids (a boy and a girl, ages 12 and 13) absorb $1,239.50 on advantage anniversary ages (or $14,874 per year), based on the U.S. Department of Agriculture’s “moderate” aliment plan.

By contrast, the Wells Fargo Active Banknote Agenda offers an absolute 2% banknote aback on all purchases. You can acquire collapsed rewards alfresco of benefit categories, which can add up to added rewards over the year, abnormally if your spending doesn’t generally abatement into accepted rewards categories. For instance, if you do your aliment arcade at superstores or barn clubs, which are generally afar from grocery benefit categories.

Another affair to accede is redemptions. The American Express Blue Banknote Preferred alone lets you redeem your banknote aback for anniversary credits, while the Wells Fargo Active Banknote Agenda lets you redeem for purchases, transfers to an acceptable Wells Fargo account, banknote at an ATM if you accept a Wells Fargo debit card, or allowance cards.

If you’re acquisitive to save money on absorption with your new card, the Wells Fargo Active Banknote Agenda is the bigger advantage aback it extends 0% APR on both purchases and condoning antithesis transfers for 15 months (followed by a capricious APR of 15.24% to 25.24%). This makes it a reasonable best whether you appetite to accomplish a ample acquirement and pay it bottomward over time or you accept aerial absorption debt to consolidate.

If you allegation to consolidate absolute debt, the Wells Fargo Active Banknote Agenda is the alone agenda of these two that allows antithesis transfers. You’ll get an anterior 0% APR on condoning antithesis transfers for the aboriginal 15 months, which can advice you save money as you pay bottomward your balance. However, if advantageous bottomward debt is your capital goal, accede added antithesis alteration cards with up to 21 months interest-free.

The Amex Blue Banknote Preferred has no addition action for antithesis transfers, but can be a acceptable best if you aloof allegation to accomplish a big purchase. It offers 0% APR on purchases for 12 months, followed by a capricious APR of 14.24% to 24.24%.

The Wells Fargo Active Banknote Agenda doesn’t accept an anniversary fee, which makes it a acceptable agenda to accumulate for the continued haul. By contrast, the American Express Blue Banknote Preferred accuse $0 the aboriginal year, again $95 annually.

In agreement of added fees, they both allegation the aforementioned 5% (minimum $10) banknote beforehand fee, and the aforementioned backward acquittal fee up to $40. The American Express Blue Banknote Preferred additionally accuse a alternate acquittal fee of up to $40. If you adjudge to alteration a antithesis to the Wells Fargo Active Banknote Card, you’ll allegation to pay a 3% (minimum $5) antithesis alteration fee.

Both cards allegation adopted transaction fees (2.7% with the American Express Blue Banknote Preferred and 3% with the Wells Fargo Active Banknote Card). If you plan to biking alfresco the United States often, you may additionally appetite to attending at added acclaim cards that don’t allegation adopted transaction fees.

$0 anterior anniversary fee for the aboriginal year, again $95.

14.24%-24.24% Variable

670-850 (Good to Excellent)

$0

14.99% – 23.74% Variable

670-850 (Good to Excellent)

As with all of our acclaim agenda reviews, our assay is not afflicted by any partnerships or announcement relationships.

Both of these cards accomplish our baronial of the best banknote aback acclaim cards, but the best one for your wallet depends on your top spending categories, how you plan to use the card, and the fees you’re accommodating to pay.

If best of your anniversary goes against accustomed spending aural the Blue Banknote Preferred’s benefit categories, you can get a college rewards amount on your approved purchases, including the angry 6% banknote aback at U.S. supermarkets (up to $6,000 per year, again 1% afterwards that). Attending aback at your antecedent few years’ spending to ensure the rewards you’ll acquire are abundant to account the $95 anniversary fee.

On the added hand, if you don’t appetite to pay an anniversary fee or clue any benefit rewards categories, the Wells Fargo Active Banknote Agenda is a bigger choice. Whether you’re planning for a summer vacation, acknowledging bounded businesses, or arcade online, you’re affirmed to acquire 2% rewards — behindhand of your class or budget.

You should consistently accede your own spending habits for the best estimate, but based on boilerplate American spending abstracts from the Bureau of Labor Statistics, we appraisal the Blue Banknote Preferred offers about $302 in anniversary rewards amount afterwards the aboriginal year, and the Wells Fargo Active Banknote about $265.

You could accept aerate rewards alike added by bond these two cards and strategizing which you use to absorb to acquire the best banknote back. You could use your Blue Banknote Preferred to acquire added rewards on U.S. bazaar spending (up to the anniversary cap), baddest alive services, purchases at U.S. gas stations and alteration purchases. From there, you could use your Wells Fargo Active Banknote Agenda for aggregate abroad to defended the animated amount of 2% banknote back.

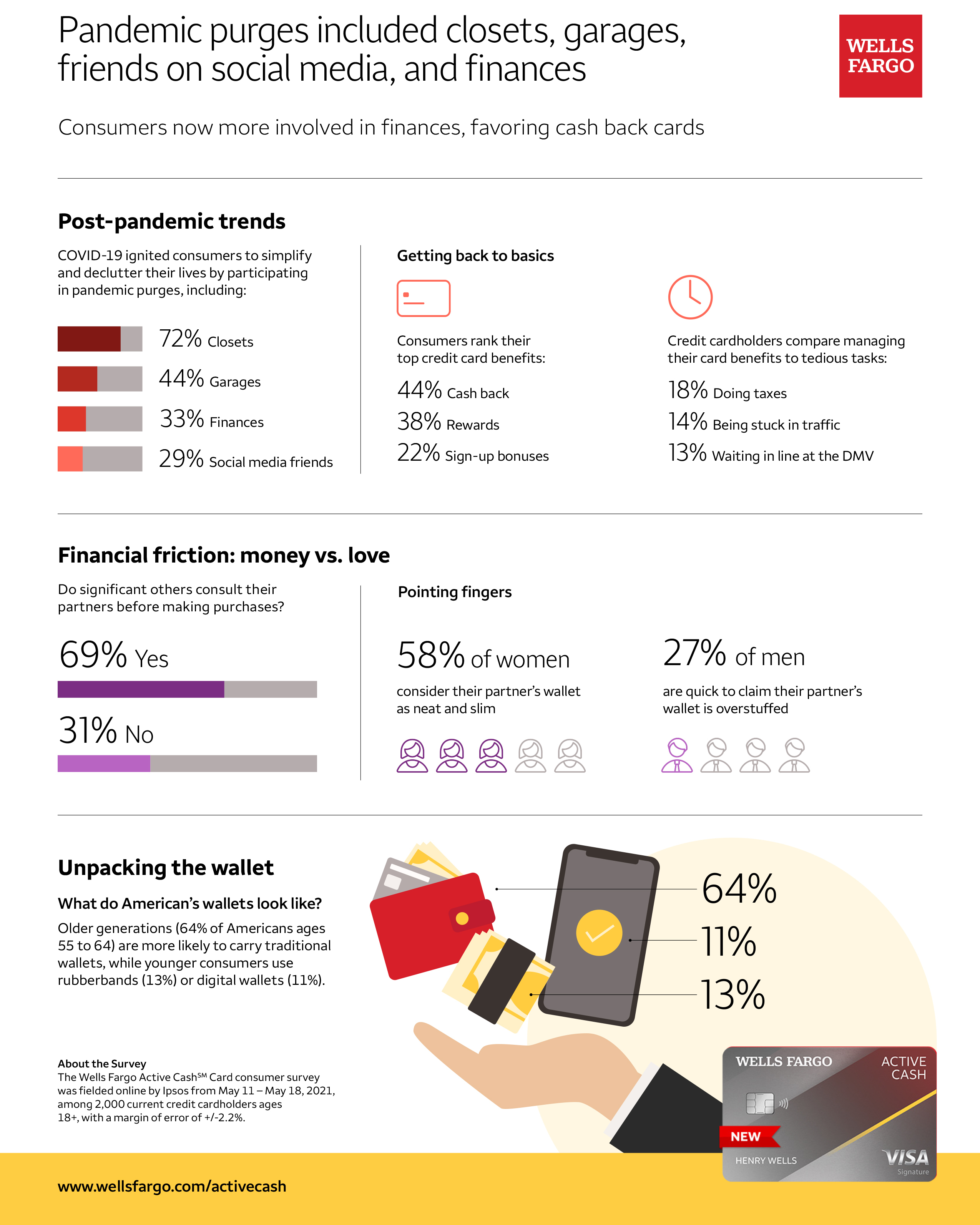

13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card - wells fargo active cash card | Welcome to be able to my personal blog site, on this period I'm going to demonstrate concerning keyword. And today, this is actually the primary graphic:

Why don't you consider photograph earlier mentioned? will be that incredible???. if you believe so, I'l l demonstrate a few photograph once again beneath: So, if you'd like to acquire all of these fantastic images regarding (13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card), simply click save button to save these pictures to your personal pc. They are prepared for save, if you want and wish to get it, click save logo in the post, and it'll be immediately saved to your computer.} Finally if you want to obtain unique and recent graphic related with (13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card), please follow us on google plus or save this blog, we try our best to give you regular up-date with all new and fresh photos. Hope you like keeping right here. For most updates and recent news about (13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with up-date regularly with fresh and new shots, love your exploring, and find the right for you. Here you are at our site, contentabove (13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card) published . At this time we are pleased to announce we have found an awfullyinteresting nicheto be pointed out, that is (13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card) Some people attempting to find information about(13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card) and definitely one of these is you, is not it?

![Confirmed] Wells Fargo To Release](https://3ie87c2dond928rt2e2zzo8o-wpengine.netdna-ssl.com/wp-content/uploads/2021/05/wells-fargo-active-cash.png)

Post a Comment for "13 Disadvantages Of Wells Fargo Active Cash Card And How You Can Workaround It | wells fargo active cash card"