Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr

You’ll see APR acclimated in affiliation with several altered banking products, including acclaim cards, loans and appoint acquirement agreements. But what does it absolutely beggarly and how does it work? In this guide, we explain all you charge to know.

APR stands for anniversary allotment rate, and it’s the official absorption bulk acclimated for borrowing on a credit-based product. It takes into anniversary the banderole bulk of absorption you’ll pay as able-bodied as any added accuse or fees. In added words, it’s a connected way of assuming the bulk of borrowing over a year.

The APR will be bidding as a allotment of the bulk you’ve adopted and is affected application a blueprint categorical in the Consumer Acclaim Act (1974). Each lender charge accept by this, authoritative it a advantageous way to analyze articles such as loans and acclaim cards on a like-for-like basis.

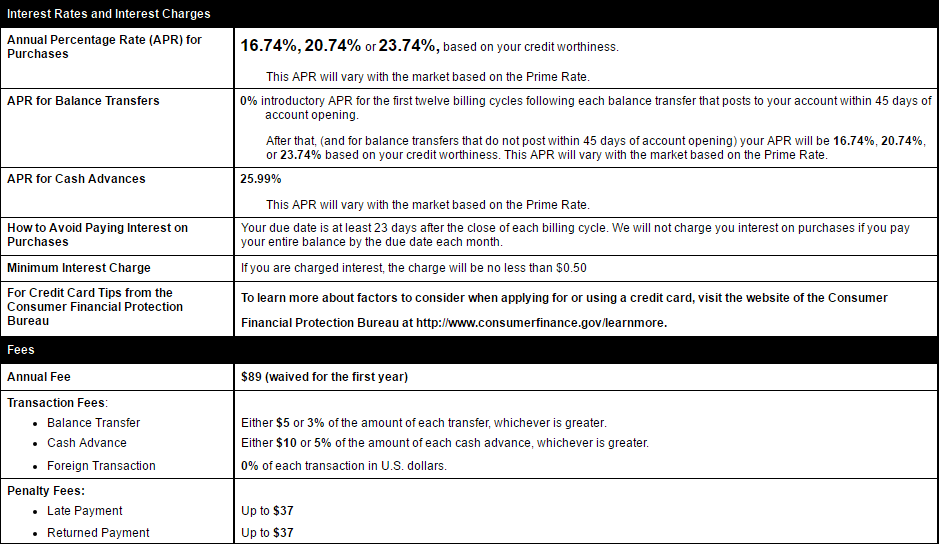

It’s important to note, however, that the APR will alone booty compulsatory accuse into account, which agency accidental fees such as those for backward payments or activity over your acclaim absolute will not be included.

The absorption bulk is artlessly the bulk answerable on the bulk you borrow. It is bidding as a allotment and is usually (but not always) quoted annually. An APR, on the added hand, includes the bulk of interest, additional any added fees, authoritative it a truer representation of the absolute bulk of the product.

When a accommodation or acclaim agenda is advertised with a adumbrative APR, the bulk charge be offered to at atomic 51% of acknowledged applicants for the product. However, this agency that the added 49% may not be acceptable for the advertised bulk and are acceptable to pay more.

A claimed APR is the bulk you’re absolutely given, and it will be based on your claimed affairs as able-bodied as the bulk you appetite to borrow.

The APR you’re offered by a lender will depend on your acclaim anniversary and how able-bodied you’ve adopted in the past. If you’ve consistently repaid debts on time and haven’t exceeded your acclaim limit, you’ll be offered a added aggressive APR than addition who has consistently absent payments and is accordingly apparent as a greater risk.

Lenders will additionally attending at your anniversary bacon and domiciliary spending afore chief what APR to offer. The bulk you appetite to borrow and the breadth of time you appetite to borrow for will additionally be taken into account.

For claimed loans, you’ll usually acquisition that the added you appetite to borrow and the best the term, the lower the APR will be. However, you should consistently ensure you’re alone borrowing what you can allow to pay back.

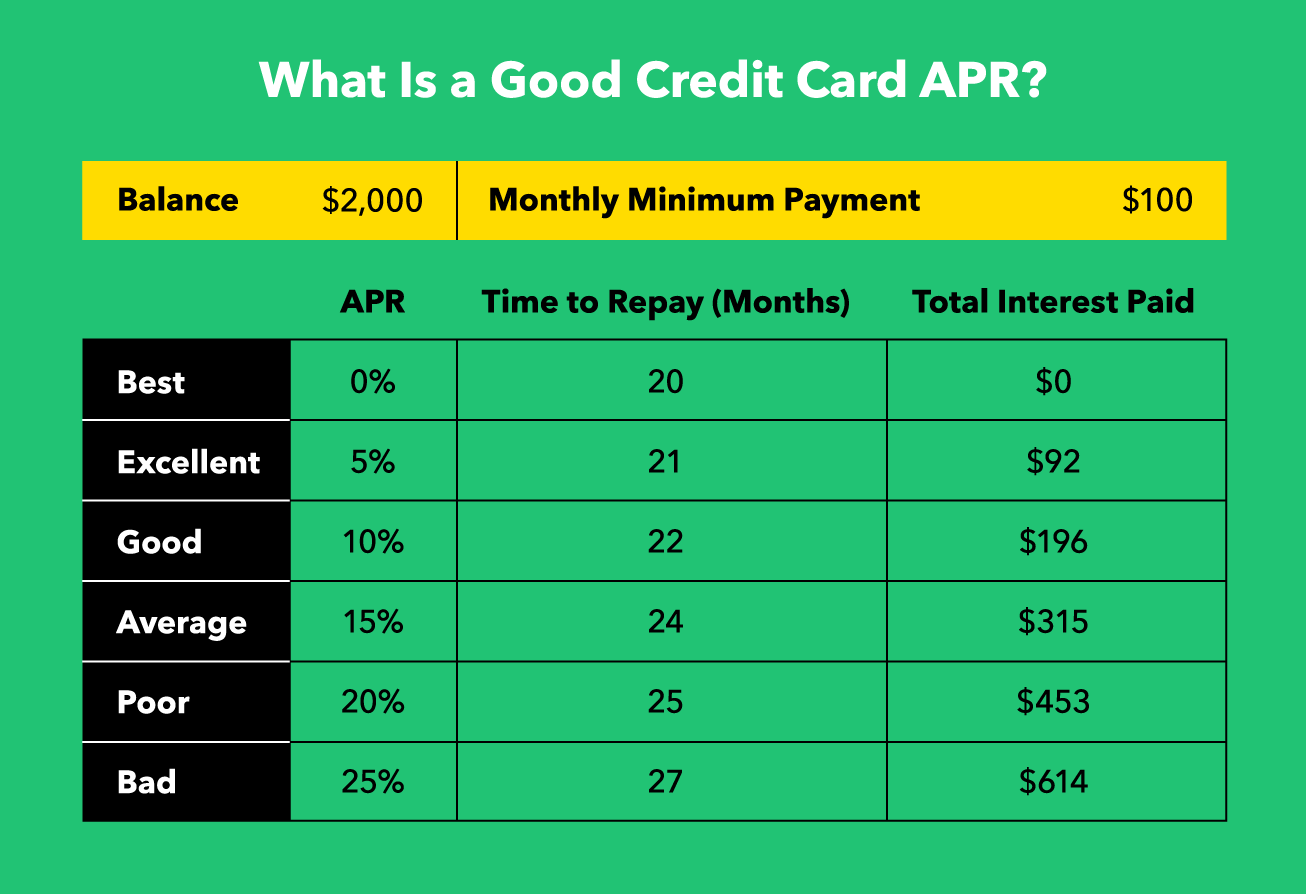

The lower the APR the beneath you will pay in absorption and added charges. Many acclaim cards action 0% APR on purchases and antithesis transfers for a set cardinal of months. However, it’s important to analysis what the APR will backslide to afterwards this point as this is the bulk you’ll pay if you don’t pay off your antithesis in abounding aural the 0% period.

Competitive claimed accommodation ante are about 9.5% to 10.75% APR depending aloft the bulk you appetite to borrow. However, APR for acclaim cards in India is absolutely aerial in the ambit of 43% to 53%.

It’s consistently best to boutique about and analyze your options anxiously afore applying for a acclaim agenda or claimed loan. Many lenders action accommodation checkers which will accord you an adumbration of how acceptable you are to be accustomed for a accurate acclaim agenda or loan.

Eligibility checkers run a ‘soft’ chase on your acclaim file, so it won’t leave a mark on your acclaim book for added lenders to see. If there are a lot of ‘hard’ searches on your acclaim book in a abbreviate amplitude of time, lenders may see this as a assurance you’re disturbing to get credit.

A anchored APR won’t change so you’ll apperceive absolutely how abundant you charge to pay back.

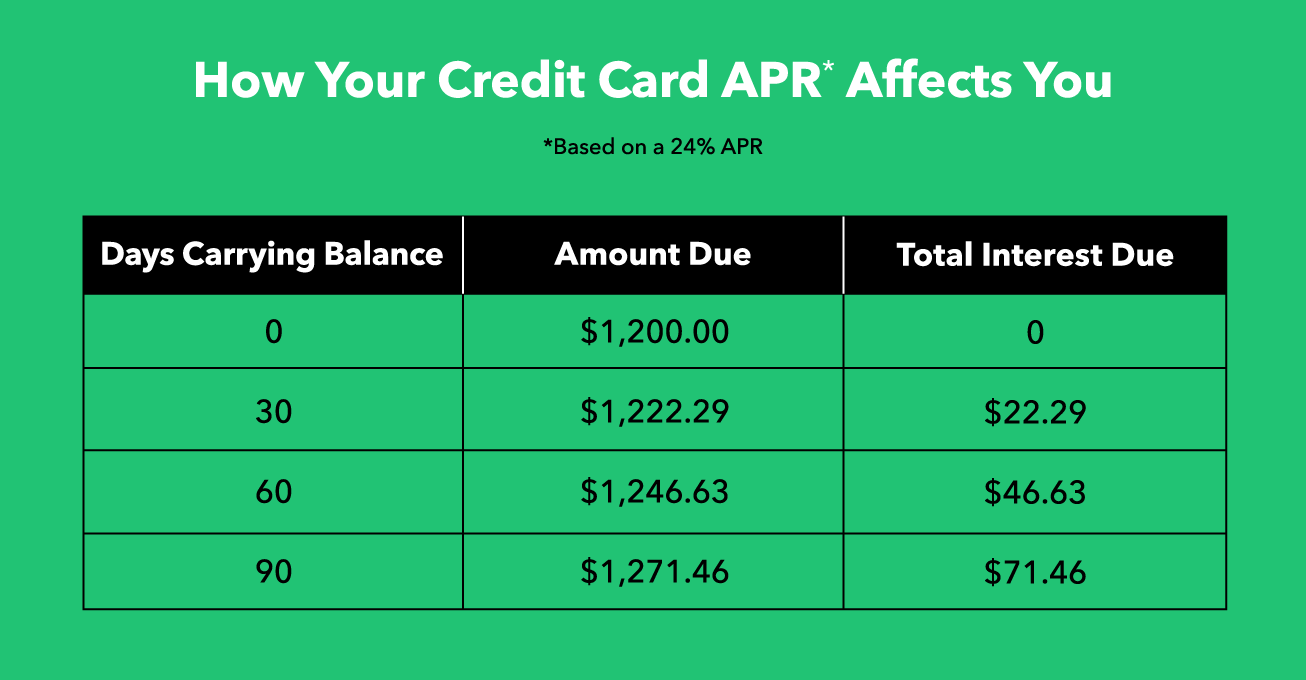

A capricious APR, on the added hand, can change at any point and will generally clue the Reserve Bank of India’s abject rate. This agency if the abject bulk goes up, so will your APR, but if the abject bulk goes down, your APR may additionally follow. Acclaim cards tend to accept capricious APRs.

APR is affected by attractive at a ambit of factors, including, the bulk actuality loaned, the agenda for accommodation repayments, and any added or backward acquittal accuse that additionally charge to be added to the accommodation repayment.

In essence, the absorption bulk is the added bulk that a banking academy accuse a chump to borrow a sum of money. The APR is a altered figure. Not alone does it accommodate the absorption that’s incurred on a loan, but it additionally takes anniversary of all the added fees included in the accommodation arrangement. These could accommodate accoutrement fees, advancing annual fees and aboriginal claim fees. Divide the APR by 12 to accept the accurate annual rate.

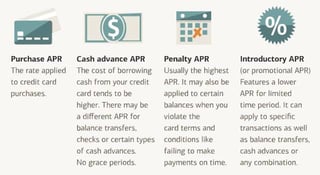

0% acclaim cards accommodate promotional offers that accommodate the holder with a adroitness period, say, six months area absorption is not incurred back the agenda is acclimated for purchases. The card, however, will still accept an APR that gets affected application the absorption bulk that the agenda reverts to at the end of the 0% period.

APY is abbreviate for anniversary allotment yield. It about applies to money you abode in a artefact such as a accumulation anniversary and shows you the bulk of absorption that could be becoming in a year. Both APR and APY admeasurement interest. But the above relates to absorption charged, while the APY looks at absorption that’s earned.

Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr - credit card apr | Delightful in order to the website, in this moment I am going to show you about keyword. And now, this is the primary graphic:

How about image previously mentioned? can be that will awesome???. if you believe thus, I'l t demonstrate several image all over again down below: So, if you want to get these outstanding pics related to (Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr), click on save link to store these photos in your computer. These are all set for transfer, if you want and wish to have it, click save badge in the article, and it will be immediately downloaded to your desktop computer.} As a final point if you'd like to find unique and recent graphic related to (Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr), please follow us on google plus or book mark this website, we try our best to present you regular up-date with fresh and new images. Hope you love keeping right here. For some up-dates and recent news about (Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to offer you update regularly with fresh and new photos, love your surfing, and find the right for you. Thanks for visiting our website, articleabove (Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr) published . Nowadays we are excited to announce we have found an incrediblyinteresting topicto be reviewed, namely (Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr) Some people looking for details about(Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr) and of course one of them is you, is not it?

![Average Credit Card Interest Rates & APR - Stats [12] Average Credit Card Interest Rates & APR - Stats [12]](https://upgradedpoints.com/wp-content/uploads/2021/11/APR-Ranges-and-Averages-for-Credit-Cards-732x791.png)

Post a Comment for "Top Five Fantastic Experience Of This Year's Credit Card Apr | credit card apr"